internet tax freedom act us code

The subcommittee met pursuant to notice at 1001 am in room 2237 Rayburn House Office Building Hon. The Internet Tax Freedom Act HR.

The Internet Tax Freedom Act ITFA Title XI of the Omnibus Appropriations Act of 1998 was approved as HR.

. 71 rows Internet Tax Freedom Act. Gekas chairman of the subcommittee presiding. The Internet Tax Freedom Act was been celebrated for making the Internet a duty free zone.

See 47 United States Code Section 151. FOUR-YEAR EXTENSION OF INTERNET TAX MORATORIUM. However a number of important questions are left unanswered by lawmakers regarding its future.

644 the Trade Facilitation and Trade Enforcement Act of 2015. 1 1998 when the US. To establish a national policy against State and local interference with interstate commerce on the Internet to exercise congressional jurisdiction over interstate commerce by establishing a moratorium on the imposition of exactions that would.

The Internet Tax Freedom Act ITFA enacted in 1998 was intended to protect the developing internet technology. The Hill is a top US political website read by the White House and more lawmakers than any other site -- vital for policy politics and election campaigns. The Internet Tax Freedom Act established a moratorium on the imposition of state and local taxes on.

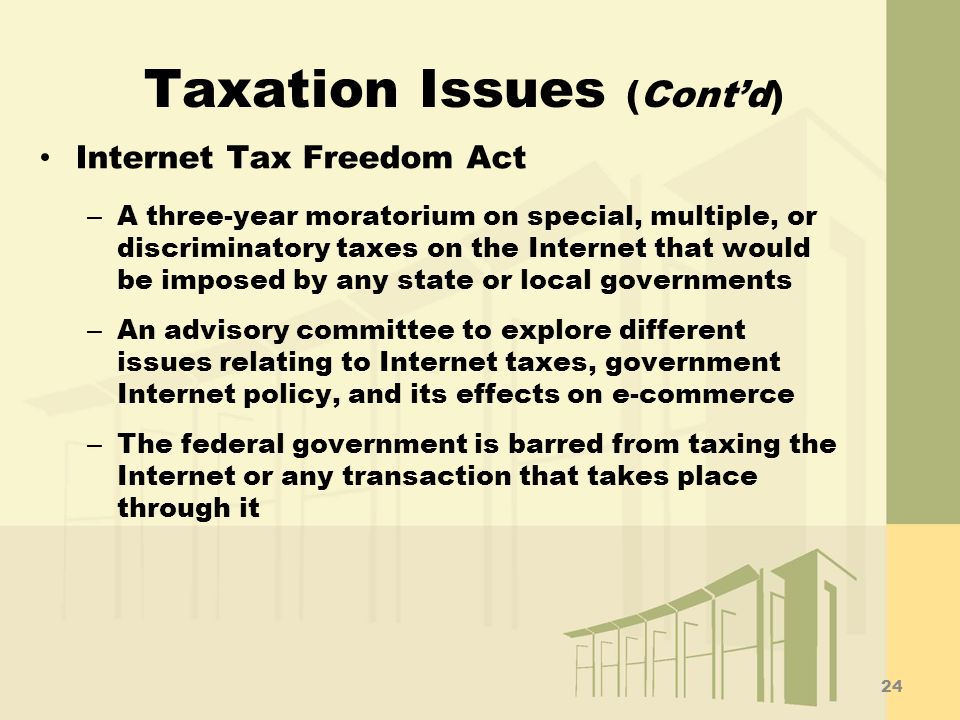

On February 11 2016 the US. Internet Tax Freedom Act of 1998 - Prohibits for three years after enactment of this Act any State or political subdivision from imposing assessing collecting or attempting to collect taxes on Internet access bit taxes or multiple or discriminatory taxes on electronic commerce with exceptions for. In fact what the Internet Tax Freedom Act does is very modest.

The Internet Tax Freedom Act ITFA the moratorium on taxing internet access was recently extended to December 11 2014 from its initial expiration date of November 1 2014. GRANDFATHERING OF STATES THAT TAX INTERNET ACCESS. On July 1 2020 the Permanent Internet Tax.

Permanent Internet Tax Freedom Act. Christopher Cox R-Calif and Sen. 151 note is amended by striking during the period beginning November 1 2003 and ending October 1 2015.

151 note is amended to read as follows. On November 1 2007 President Bush signed the Internet Tax Freedom Act Amendment Act of 2007 into law. 1 Internet access taxes imposed under specified State.

Ron Wyden D-Ore the law placed an initial year-long moratorium a legally authorized period of delay on special taxation of the Internet. ITFA which prohibited states and localities from applying taxes on internet access or imposing discriminatory digital-only taxes became permanent in 2016 but included a grandfather clause that allowed states with taxes existing before 1998 to keep that. The Internet Tax Freedom Act ITFA passed in 1998 imposed a moratorium preventing state and local governments from taxing internet access.

A IN GENERALSubsection a of section 1101 of the Internet Tax Freedom Act 47 USC. INTERNET TAX FREEDOM ACT THURSDAY JULY 17 1997 House of Representatives Subcommittee on Commercial And Administrative Law Committee on the Judiciary Washington DC. Internet Tax Freedom Act.

The ITFA would institute a moratorium to preclude double taxation of electronic commerce and taxation that singles out the Internet for excise-type taxes. On February 11 the United States Senate approved a permanent extension of the Internet Tax Freedom Act ITFA which previously passed the House of Representatives on December 15 2015. Sections 1101a and 1104a2A of the Internet Tax Freedom Act title XI of division C of Public Law 105277.

4328 by Congress on October 20 1998 and signed as Public Law 105-277 on October 21 1998. On July 15 the US. A PERMANENT MORATORIUMSection 1101a of the Internet Tax Freedom Act 47 USC.

The Internet Tax Freedom Act was first enacted on Oct. House of Representatives voted in favor of HR. The Internet Tax Freedom Act 47 USC.

Internet Tax Freedom Act. This Act may be cited as the Internet Tax Nondiscrimination Act. The bill also establishes an end date of June 30 2020 for the seven states that currently impose a tax on internet access.

On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire. Internet access ie no bit tax - the monthly fee paid to an ISP for service cannot be. The United States of America in Congress assembled SECTION 1.

Hawaii New Mexico North Dakota. 21 1998 112 Stat. Internet access and the internet economywhich are key drivers of productivity equality and.

Senate approved a permanent extension of the Internet Tax Freedom Act that was included in HR. Additionally ITFAs Grandfather Clause which allows certain states to continue to tax Internet access is phased out. C title XI Oct.

Passed by House of Representatives June 23 1998. 151 note shall be applied by substituting October 1 2016 for October 1 2015. 151 note is amended 1 in section 1101a by striking 2007 and inserting 2014 and 2 in section 1104a2A by striking 2007 and inserting 2014.

Summary of HR235 - 114th Congress 2015-2016. 3086 the Permanent Internet Tax Freedom Act PITFA by a voice vote. It extends the prohibitions against multiple and discriminatory taxes on electronic commerce until November 1 2014.

Congress voted to pass the legislation. ITFA prohibits Internet access taxes multiple taxation of a single transaction by more than on taxing jurisdiction and discriminatory taxes that do not apply to offline. PITFA would permanently extend the moratorium on state and local taxation of Internet access and multiple.

Introduced more than a year earlier in March 1997 by Rep. 442 would call time-out on taxes that discriminate against electronic commerce and the Internet. Internet Tax Freedom Acts prohibition against taxing internet access applies to all states beginning July 1 2020.

E Commerce In 2022 Issues Actors And Controversies

Global Survey On Internet Privacy And Freedom Of Expression

Cell Phone Taxes And Fees 2021 Tax Foundation

E Commerce In 2022 Issues Actors And Controversies

A Guide To Anti Misinformation Actions Around The World Poynter

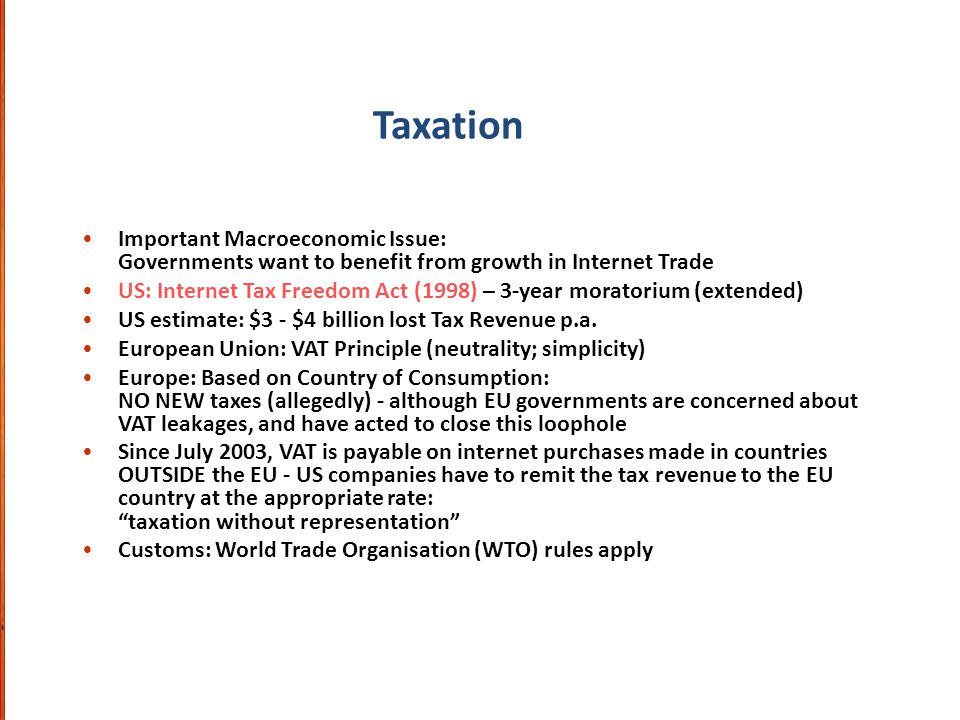

E Core Values Ethical Legal Taxation And International Issues Ppt Video Online Download

E Commerce In 2022 Issues Actors And Controversies

E Commerce In 2022 Issues Actors And Controversies

The History Of Iana Internet Society

Internet Sales Tax Definition Taxedu Tax Foundation

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Ethical Legal And Public Policy Issues In E Business Ppt Download

E Commerce In 2022 Issues Actors And Controversies

E Commerce In 2022 Issues Actors And Controversies

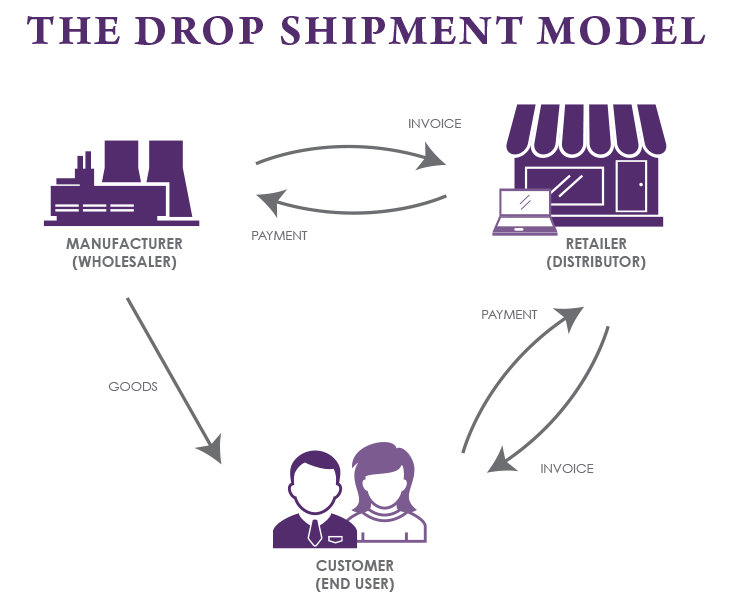

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute